Research reveals that there are top performers within each industry, confirming that some companies – facing similar competitive pressures and environmental challenges – are more profitable and growing significantly faster than their competitors.

Times have been tough lately in Europe. A violent financial crisis, high volatility in inflation and exchange rates, increasing competitive pressure... How do companies resist, or even better generate their own organic sustainable and profitable growth? One explanation lies in pricing power.

In 2011, Warren Buffet, the billionaire CEO of Berkshire Hathaway Inc., shared his wisdom with the Financial Crisis Inquiry Commission in the US and explained that he rates businesses based on their ability to raise prices and sometimes doesn’t even consider the management in charge. The quote is now famous:

“If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.”

What is pricing power then? Can we consider it as a predictor of financial performance as Buffet’s quote suggests? These are two of the questions underlying the research I presented at the 2015 conference of the European Marketing Academy (EMAC) with my colleague Vinay Kanetkar from Guelph University.

Who are the pricing power leaders?

Looking at several competitive sectors, companies like Marriott, Pfizer, Caterpillar and Sealed Air score high.

These companies started early on their pricing journey, and are known for the superiority of their holistic approach.

Marriott, for example, has a 20-year history of applying revenue management to individual bookings in the hospitality sector. The team is large and highly skilled, and supported by a powerful in-house tool – Group Profit Optimizer (GPO) – that maximizes revenue and profits from all of the hotel’s customers.

Pfizer is also an iconic company, recognized for its ability to lead price increases and extract significant value from the market. Pricing at Pfizer is high on the corporate agenda and, interestingly, covers two main areas: pricing and revenue management.

Caterpillar is a great example of success in a highly competitive and volatile environment, thanks to a high level of maturity on value measurement and pricing execution. The economic value of its product is systematically measured which gives confidence to salespeople to defend the price premium, the brand and value attributes, such as uptime. Pricing execution is also central, and salespeople and management teams are trained on specific scenarios, which has proven particularly helpful in downturn periods.

Our last leader is Sealed Air, who make products like the bubble wrap used to protect goods in containers. Here again, value-based pricing is implemented at a very mature level, meaning that value is consistently measured, protected (+4,000 patents), and extracted through a very sophisticated razor-and-blades approach: customers lease patented equipment from the company that can only use Sealed Air film. Another interesting trait is that the results of this superior pricing power are constantly communicated to financial analysts and hence reflected in the stock value.

The (true) impact of pricing power

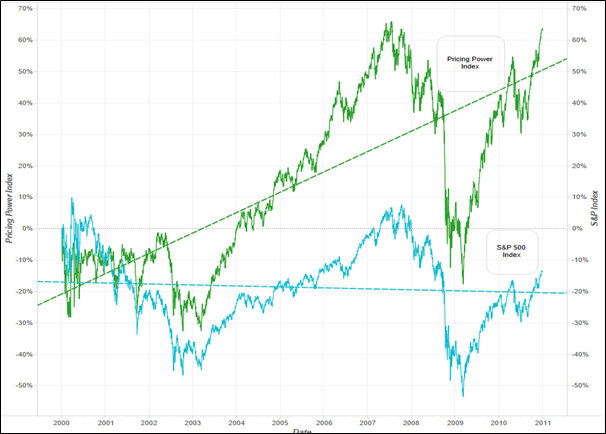

So does pricing power matter? As the Sealed Air example shows, superior pricing power leads to superior financial results. And this is what our research showed when we compared the stock value of the top performers in pricing power vs. the S&P 500 index. The figure (below) is clear – companies with superior pricing power clearly outperform their F500 competitors.

Understanding the impact of pricing power, and more broadly the impact of value creation on profit, is crucial for managers. The approach followed in our research offers a new perspective on the trade-offs between value creation and capture of premium at the corporate level. Pricing power as we calculate it (i.e. at the corporate level) offers an interesting insight into the differences among companies in their ability to transform brand equity (for example) into superior and sustainable top line growth.

Figure. Index of market capitalization for 55 firms with superior pricing power (Pricing Power Index) compared to that for all Fortune 500 companies (S&P 500 Index).

Novel definition with two specific advantages

The concept of pricing power is related to the traditional definition and operationalization of competitive advantage through the work of Michael E. Porter and Pankaj Ghemawat, among other strategists. The main idea is that if you can’t compete on costs, your results (i.e. industry margin + competitive advantage) must come from increasing volume, increasing differentiation or increasing willingness to pay.

If we look more specifically at what kind of role pricing plays in the competitive advantage formula, we can define pricing power as “the process through which organizations extract a superior value from the market as a result of

- a higher willingness to pay for their products (and therefore a lower price sensitivity) and/or

- superior marketing and sales efficiency (and therefore a higher price to profit ratio).”

This definition, although more complex than others, has two advantages. First, it is consistent with best practices in pricing transformations that focus on the two main dimensions of pricing: value-based pricing (capturing value) and pricing efficiency (extracting value, i.e. a higher net price). Second, the two dimensions of our definition (price sensitivity and price to profit) can be measured to benchmark companies using a reliable indicator of pricing power.

How the research was done

To test the definition empirically, a large dataset of 260 leading companies among the Fortune 500 was built using 11 years of quarterly financial results (2000–2011).

Each company's pricing power performance within its own industrial sector was calculated from the financial statements using a mathematical derivation which allowed differentiation of the two distinct traits of pricing power: lower price sensitivity (resulting from a higher willingness to pay for products) and higher capacity to extract value from the market (i.e. positive price to profit ratio).

The industry-specific approach was applied systematically to the dataset and 55 companies with superior pricing power extracted. Finally, an index was constructed for the market capitalization of these firms (Pricing Power Index) and compared with the S&P 500 Index.

Dr. Manu Carricano is Associate Professor and Director of Pricing Center in EADA Business School, the first pricing research center in Europe. He is the co-instructor with Dr. Pekka Mattila at Aalto EE's Strategic Pricing program.